Reprinted with permission of Condo Media magazine, the official publication of the CAI New England Chapter

The following article was written by Tony Chiarelli, President, Landmark Associates, and appeared in the February edition of Condo Media Magazine which is published (and reprinted with permission) by the Community Associations Institute, New England Chapter (CAI-NE).

When a property damage event like a pipebreak or fire happens, the process of a condominium unit owner will go through will be both daunting and exhaustive. I use the term “will be” as opposed to “may be” to set expectations – expectations of timelines that revolve around multiple parties and, in most cases, multiple units within the association.

Many articles cover how to plan and prepare for one of these events from both the property manager and the unit owner perspectives, but let’s take a tour of an actual event for those unit owners and properties who have never experienced this type of unfortunate occurrence.

The first thing to realize is the resolution of this type of even will take months, not days or even weeks. As soon as a condominium unit owner accepts this fact, it makes the rest of the process somewhat easier to handle. Granted, nobody likes to be displaced from their home. However, like any unpleasant life event, understanding the process of what’s happening will lessen the frustration and disappointment.

Sprinkler Pipe Break

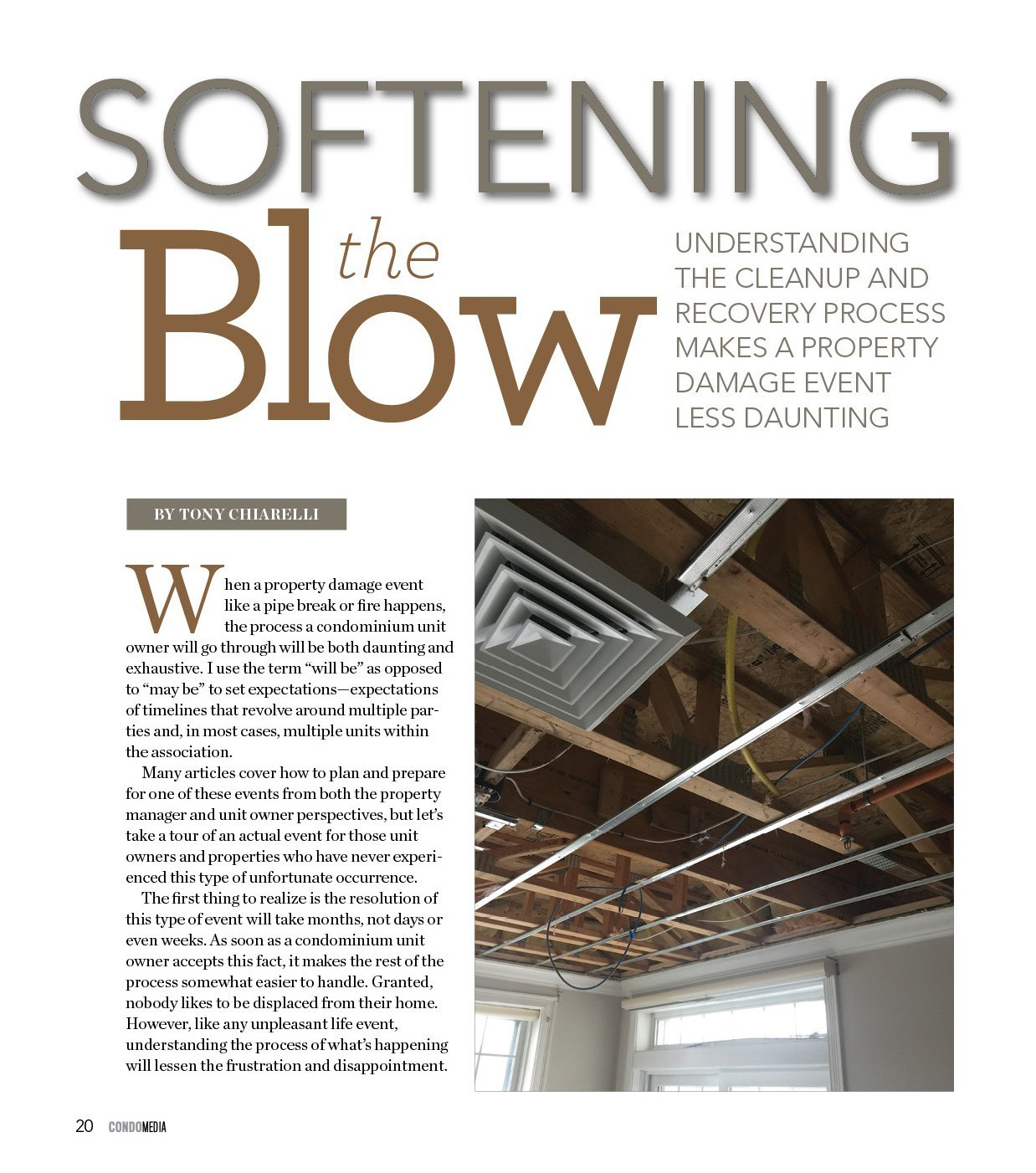

A three-story, two-building, multiple- unit condominium complex constructed around 2002 had a PVC sprinkler line burst open at two different locations: one in each building and both originating on the third floor.

Almost identical events, the third-floor units had major damage but only to the bedroom just below the break. Second-floor units had major damage to the same bedroom and the adjoining kitchen and all of the flooring because that level is a concrete substrate and the water runs across the entire unit. First-floor units sustained major damage in every room because the water traveled across the second-level floor and came down along every exterior wall and floor opening. Property mitigation and demolition took two weeks.

Roles and Expectations

The property manager and trustees are responsible for two things: mitigation of damage to the common areas and notifying the master policy insurance company of the event. Unit owners are responsible for notifying their own HO6 homeowners’ policy insurance company.

Unit owners need to remember their property manager and trustees are bound to the overall insurance process and limited in what they can do. They have no power or influence over the schedule of the insurance company’s adjuster, mitigation contractor’s schedules, etc.

Insurance adjusters will be notified by the carriers, and then, they will schedule a property visit to ascertain the extent of the damages. The unit owner’s homeowners’ adjuster only has to make their determinations in their specific unit.

The master policy adjuster has to do the same but for every unit affected. This is the first piece of frustration for a unit owner. In our event, eight units were affected, some with significant damage, along with several common area hallways, a community room, and lower-level garage ceiling. It generally takes weeks for an adjuster to put larger claims together; in this case, it took six to eight weeks.

The unfortunate part for the individual unit owners is their individual claims (which all exceeded the master policy deductible) cannot be settled until the entire claim is processed. This process gets more complicated in smaller claims because now both insurance carriers have to agree on who’s responsible to pay for which part of the claim.

Once the insurance carrier offers the claim, the property manager and trustees determine the dollar amounts to be distributed to the unit owners who are then responsible to hire their own contractor. Unit owners need to remember at this stage that the property manager and trustees will need time to review the claim to protect the interests of the association.

One way to help the process along is for the unit owners to obtain contractors’ quotes based on what they think needs to be done to restore the unit while the insurance carriers assemble the claim offer. Then, as soon as the claim money is allocated, they can compare the quotes and determine if there’s enough money being offered.

Unforseen Hiccups

Remember, this can be a slow process. The adjuster inadvertently missed a few items in each unit. Also, the eight unit owners hired two different contractors to work in multiple units. The first contractor got out ahead of the process and presented the adjuster with the necessary increases for the missed items in five of the units, but because the second contractor’s schedule lagged behind the first, the adjuster needed to wait to process all of the claim supplements together. This is one large claim, and you’re all in this together.

In the construction stage, we discovered a few issues. The manufacturer no longer offered the cabinets used by the developer. In addition, the engineered hardwood flooring was no longer avail- able by the manufacturer in the same thickness if the unit owner wanted to stay with the same finish color/stain.

Contractors had to submit supplemental claims for unforeseen conditions and ask the insurance company for additional funding for the cabinetry upgrades. In some cases, only the lower units were affected and not the upper ones, but with the unavailability of the cabinetry lines, the entire kitchen had to be replaced. Same story for the engineered hardwood flooring which couldn’t be matched: The entire floor of the unit had to be replaced.

Due to lead times for replacement cabinets, specialty-engineered flooring, code upgrades, and additional supplemental claim processing, the construction period resulted in another 10 to 12 weeks.

Our event had an overall timeframe of six to eight months, as some owners occupied their unit sooner than others and one contractor finished ahead of the other one.

This is a real-life event. “Reality TV,” where they renovate and flip a home in two or three weeks, doesn’t show the weeks of behind-the-scenes preparation, material ordering, and design. Older properties built in the 1980s and 1990s are potentially subject to additional issues regarding code upgrade requirements determined by the local building officials and materials/components that either no longer exist or cannot be reutilized.

Unfortunately, in cases like this, homeowners must be prepared to be out of their homes for several months and try to make the best of it. Inquire with your insurance agent regarding coverage for loss of use.